Our Impact

We want to make an impact, and importantly, we want to track, measure and analyse the work we do through open and transparent data.

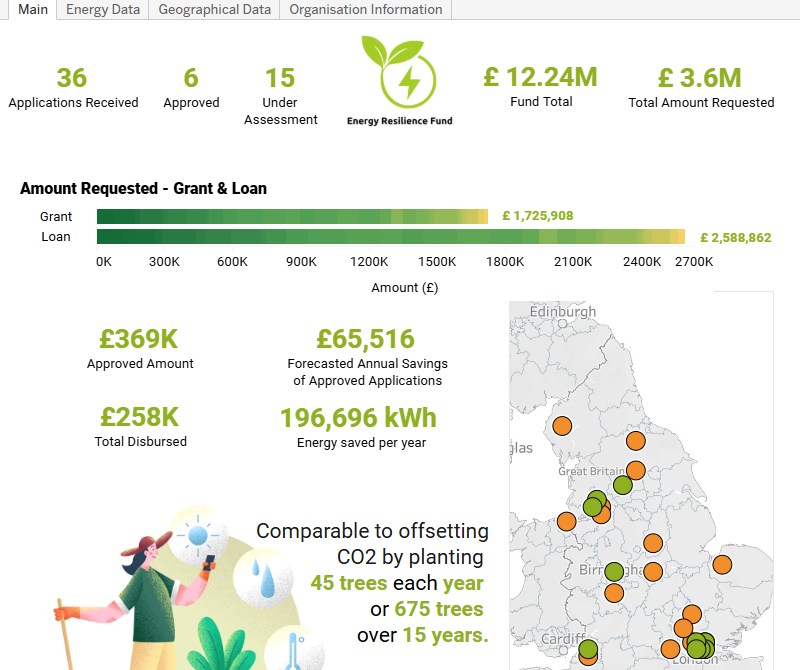

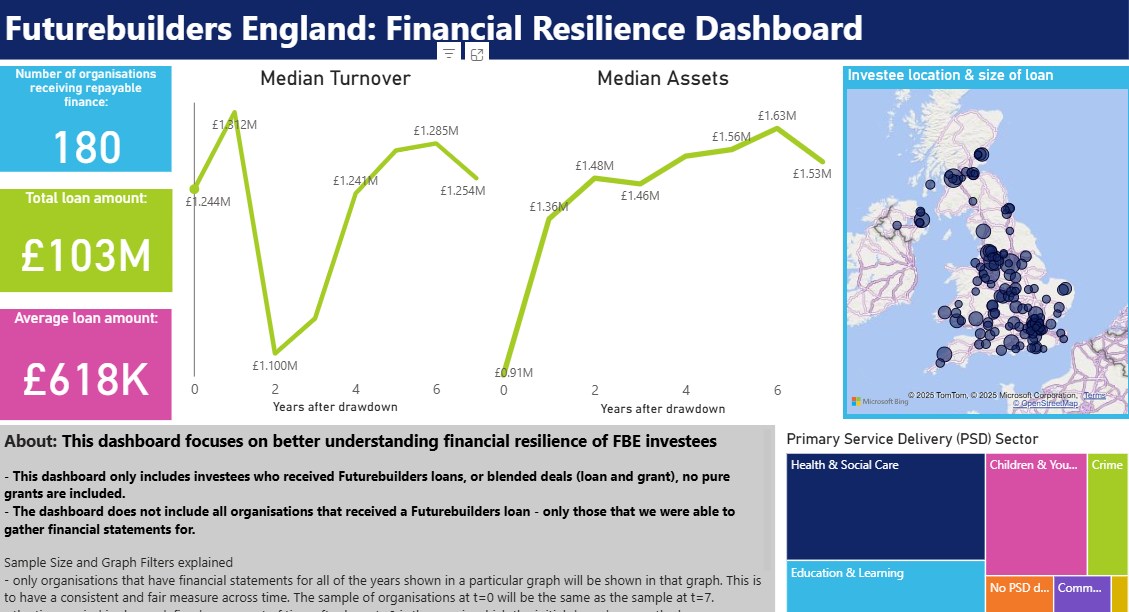

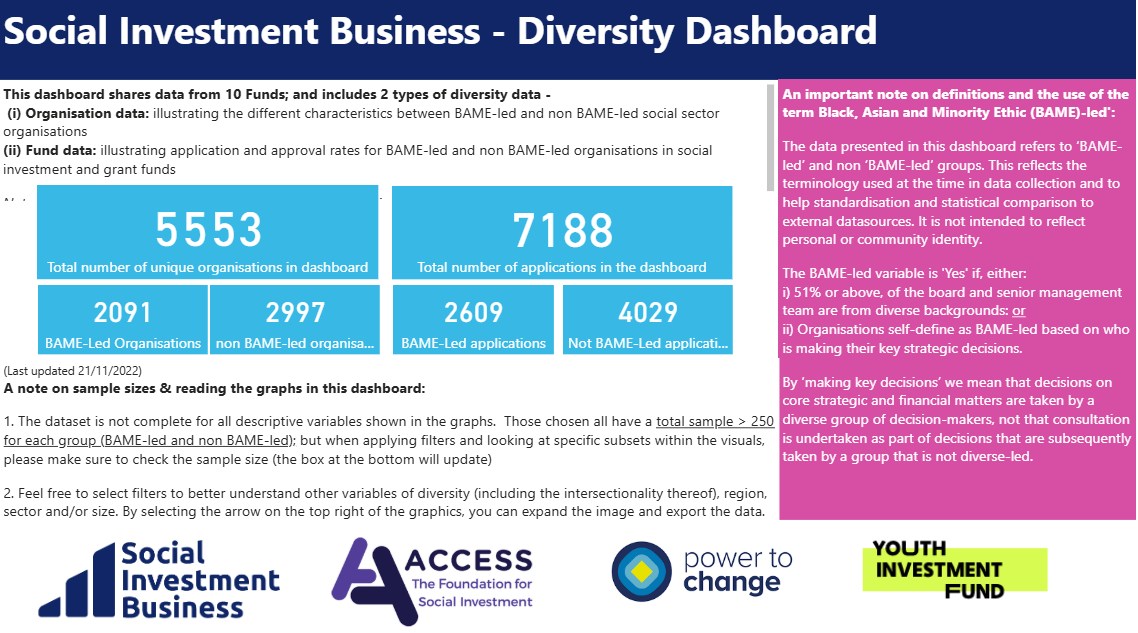

Our impact in numbers

Amount disbursed (loans and grants combined)

June 2022 | *N/A refers to historic investments where there is no location available or invalid postcode data

June 2022 | *N/A refers to historic investments where there is no location available or invalid postcode data

Dashboards

Our impact in stories

We provide finance and support to build a more equal society