Impact Report 2022-2024

Social Investment Business believes in the power of the social economy to build a more equal society. Social investment supports organisations across the country to change people’s lives, build fairer communities and create a more resilient society.

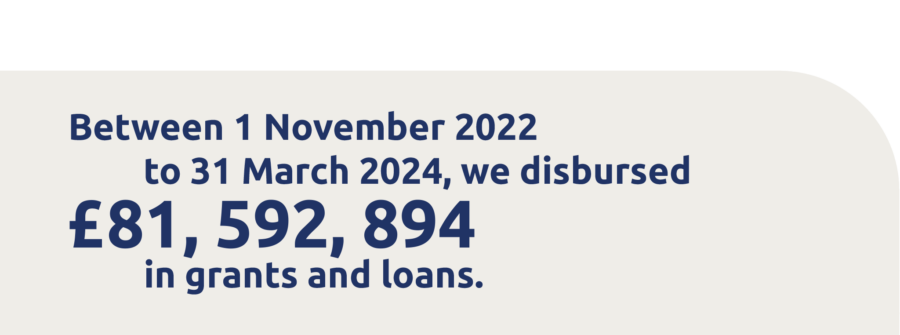

Our impact report (1 November 2022 to 31 March 2024) shows how we deliver our mission in line with our values and makes clear the substantial progress we have made in recent years in a whole range of areas – be that external investment, partnership working, data-led design and decision-making, internal systems, or diverse talent recruitment.

Our Impact

Social Investment Business’s investment funds have supported charities and social enterprises to achieve their ambitions, to develop stronger, more sustainable organisations delivering social impact, and to make a lasting difference to people’s lives in local communities.

Our track record of building resilience and strengthening charities and social enterprises through investment, grant-making and non-financial support continues to grow, with more active social investment funds, with effective grant and support programmes, and, most notably in this period, with the Youth Investment Fund – the largest fund by total amount that the organisation has ever managed.

The Youth Investment Fund has also led to a significant growth in the team, doubling in size within a year, and the progress and impact detailed in this report serves as a credit and recognition to all of our colleagues, and to their dedication and commitment. It also couldn’t be achieved without the support and flexibility of our funders, investors and partners – and, most important of all, the organisations we exist to support.

We focus on funding a more widely distributed social economy, with more diverse leadership. One of ways we improve our reach and diversity of applications we fund is by monitoring our diversity data, and making adjustments to the fund’s criteria, for example, lowering the turnover thresholds requirements for BAME-led organisations in some of our funds, enabling more organisations to apply for and secure funding.

The Reach Fund supports our aim of creating a fair and accessible social economy. Social investors are often approached by charities and social enterprises who require extra support to raise investment. The Reach Fund is a grant programme that helps charities and social enterprises raise that investment. It’s funded by Access – The Foundation for Social Investment and is open to organisations in England.

We also delivered The Enterprise Development Programme (EDP), funded by Access – The Foundation for Social Investment. This programme, now in its last year, is a grant and learning support programme for organisations that are looking to become more enterprising and generate additional income from trading.

“

Without the funding for a dedicated member of staff to spend the time required designing, trialling and implementing the model we would not be where we are and would not have the excellent local reputation we have as a provider of supported accommodation”.

Homeless Sector Organisation

Establishing and delivering the Recovery Loan Fund and Thrive Together Fund have created more opportunities to strengthen organisations and build their financial resilience, while our work in energy and environment continues to expand rapidly. The Reach Fund and Enterprise Development Programme contribute strongly to individual organisational resilience at an earlier stage of development.

Funds, like our Resilient Communities Fund, funded by Power to Change, has helped community organisations with assets that have been impacted by the cost-of-living crisis. The fund provided a flexible grant of up to £10,000 to help community businesses navigate the cost-of-living and energy crisis and improve the energy resilience of community buildings. Over £1.3m was provided in funding to 137 organisations.

The Thrive Together Fund, launched in July 2023, provides unrestricted funding to unlock the growth of small and medium sized charities and social enterprises. Despite only being launched recently, the fund has attracted significant interest and to date, £3.6m to 34 organisations have been approved.

Youth Investment Fund

In May 2022 we were selected by the UK Government to deliver its £300M+ Youth Investment Fund to invest in young people and help transform youth services where needed most. Since then, we have been powering ahead with delivery partners Key Fund, National Youth Agency and Resonance, and with colleagues at the Department for Culture, Media and Sport.

It’s the biggest grant programme we have ever delivered. So far £250m in grants have been publicly announced to 227 youth services, benefiting thousands of young people.

The first new build Youth Investment Fund youth centre opened its doors in February 2024.

“

The building of the Chichester Shed will provide an informal, dynamic and versatile space where young people can connect, learn and experience new activities. The space will be a haven for all ages and backgrounds to use throughout the school day and holidays, including intergenerational activities where boundaries can be broken down as well as adult education sessions and group workshops delivered. The Youth Investment Fund grant has enabled the project ideas to be brought to a reality!”

Clare de Bathe

CEO for the Chichester Community Development Trust

Our commitment to evidence and partnership is clear from the central role of data across our portfolio of activity–in design, delivery, decision-making-and the effective partnerships which we create, convene, and co-ordinate.

We are committed to evidence-led decision-making; using research and data analysis to improve practice and build evidence across the social sector. A data- led approach helps to ensure that funding reaches the most vulnerable communities and enables us to develop initiatives that drive effective and impactful support for social sector organisations.

We have invested in research to better understand the social sector’s readiness to meet the challenge of Net Zero. Our research shows that the social sector is falling behind the rapid pace of change in energy efficiency that is currently needed. This research has been instrumental in shaping our approach to energy strategy and investment decisions.

Partnership is at the heart of everything we do. These partnerships complement and supplement our existing capabilities, and bring additional expertise, insight, experience, reach and legitimacy across a range of sectors, communities and geographies. Our partnerships have grown significantly over this period. For example, our Enterprise Development Programme, brings six partners together –Association of Mental Health Practitioners, Equally Ours, Groundwork, Homeless Link, the Ubele Initiative, YMCA George Williams/Centre for Youth Impact.

We have focused on expanding appropriate funding from public, private and philanthropic sources.

Social Investment Business continues to be the host of the Social Investment Forum, which brings together the full range of social investors and intermediaries together to improve shared learning, collaboration, and advocacy. In 2023 the focus was increasing the visibility of social investment to politicians and policymakers as well as working with the Department of Culture, Media and Sport on how best to utilise the £87.5m of funds available from the Dormant Assets Scheme that has been designated for social investment use.

We have undertaken a wide range of policy and influencing work, including advocating with others for the Community Enterprise Growth Plan, which makes the case for further use of government dormant assets in social investment, engaging with a wide variety of politicians, particularly Ministers in the government and, and securing media coverage in a wide variety of sector and mainstream media.

Social Investment Business continues to ensure feedback from customers is collected, shared and acted upon. We continue to gather customer feedback at various stages of the application process that is tracked in our systems. This provides clear oversight of our engagement with customers to all stakeholders.

Between December 1, 2022, and March 31, 2024, we received 1592 completed surveys from our customers.

83% of our customers were either satisfied or very satisfied.

60% of our customers said the application process was easy or very easy to complete.

Our team almost doubled in size in 2023 to meet the demands associated with delivering an increased amount of funds. We have continued to be a fully remote, flexible and office free organisation. This has enabled us to attract an even more diverse and talented workforce from across the UK.

Every year, Social Investment Business carries out an employee engagement survey. The results in this year are extremely positive: staff feel motivated by the mission and purpose and 100% of staff say their line manager cares about them.

Read more about our Impact Report using the download button below.