What is the Energy Resilience Fund?

The Energy Resilience Fund (ERF) provides a blended funding package of loan (60%) and grant (40%) to bolster the energy resilience of eligible charities and social enterprises in England.

The Fund is delivered by a partnership made up of Social Investment Business, Big Issue Invest, Charity Bank, Co-operative and Community Finance, Groundwork UK, Key Fund, Resonance Ltd, The Architectural Heritage Fund, and The Ubele Initiative.

The Fund is the successor to the pilot Energy Resilience Fund managed by Key Fund. Also delivered in partnership with many of the above organisations.

Who is it for?

Charities and social enterprises based in and delivering impact in England, who are looking to improve their energy resilience. This could be for many different reasons, for example reduced carbon emissions, energy cost savings, upgrading energy efficiency ratings to meet future regulations, increased use or comfort of buildings, replacing older vehicles and equipment with modern energy efficient versions.

Am I eligible?

- Looking to install energy saving measures or generation technology to buildings/ land (including new builds), and/ or to purchase energy efficient or environmentally friendly vehicles or equipment.

- Incorporated voluntary, community or social enterprise organisation*.

- Based in England and serving communities primarily within England.

- Constituted for social benefit and improving people’s lives or the environments they live in.

- A minimum of 2 years’ operating activity.

- A minimum turnover of £100k in your last set of end of year accounts.

- Fewer than 250 employees and either an annual turnover not exceeding £40m or an annual balance sheet total not exceeding £35m.

- Unable to access mainstream bank lending for this purpose.

- Not subject to any insolvency proceedings.

- Have a viable borrowing proposal.

- Freehold ownership or a suitable written lease agreement with a minimum of 12 years remaining on it if you are applying to install energy saving/ generating measures to buildings/ land

- This application and the taking on of loan finance is supported by your senior decision makers.

- Vehicles/ equipment (any non-property related assets) should be intended to be purchased and owned by the applicant organisation and to therefore sit on the financial balance sheet of the applicant organisation

The funds cannot be used for:

- Refinancing except in exceptional circumstances.

- Community energy or heating generation projects such as district heat networks, solar or wind farms or large hydro power projects, or nuclear energy and/or where the primary purpose is to sell the energy to a 3rd party. Note – this does not prevent ERF funding an organisation from implementing an energy generating measure on their land rather than their building, but the primary purpose has to be to supply energy to their own building.

- Community energy organisations that bring groups of people or organisations together to purchase, manage, generate, or reduce consumption of energy.

- Hybrid Electric Vehicles that cannot be plugged into the mains as the engine is still the main power source. For clarity Plug in Hybrid Vehicles (PHEVS) are eligible.

- Facilities primarily for statutory services e.g. hospitals, state funded primary or secondary schools, universities etc.

- Buildings or sections of them used primarily for political campaigning.

- Buildings or sections of them used for worship/ furtherance of faith, unless:

- >50% of activity/usage of the building is for community services, and the

- Energy efficiency measures being funded benefit the areas of the building used primarily for community services.

* Must be registered as a Charity, Community Interest Company or Community Benefit Society. If registered as any other legal entity, it must have a social object, asset lock and restriction on profit distribution (must distribute less than 50% of post-tax profits) written into its governing documents.

See the FAQs below for a list of exclusions.

What could I receive?

Energy Audit Support

If you would like to apply to install energy saving/ generating measures to buildings/ land, and you don’t already have a suitable Independent Energy Assessment, we will refer you to one of the funds approved Energy Audit Suppliers for one to be carried out and paid for by the fund (subject to fund eligibility).

Note: Receipt of an Independent Energy Assessment from the fund does not guarantee you will receive the below funding. This will be subject to a full assessment of the organisation and the funding request.

Funding

| Product | Blended loan (60%) and grant (40%) |

| Amount | £25k – £250k (inclusive of 40% grant) |

| Loan Repayment Term | 1 – 10 years (inclusive of any capital repayment holiday). |

| Loan Interest Rate | 8.5% fixed per annum on loan balance. |

| Loan Arrangement Fee | 2.5% on loan value (added to loan balance). |

| Loan Repayment | Capital repayment holiday of up to 12 months at the start of the loan (optional). No early pre-payment fees. |

| Loan Security | Loans will generally be provided unsecured. We would only take security by exception. |

| Purpose | The funds can be used for the purposes of :

This includes paying for a wide range of aspects that may be required to successfully undertake the projects, and can include but is not limited to: capital costs, labour costs, project management costs, revenue losses from disruption, building management systems, training in buildings management for staff, contingency. See the FAQs below for some examples of eligible expenditure, as well as exclusions and ineligible spend.

|

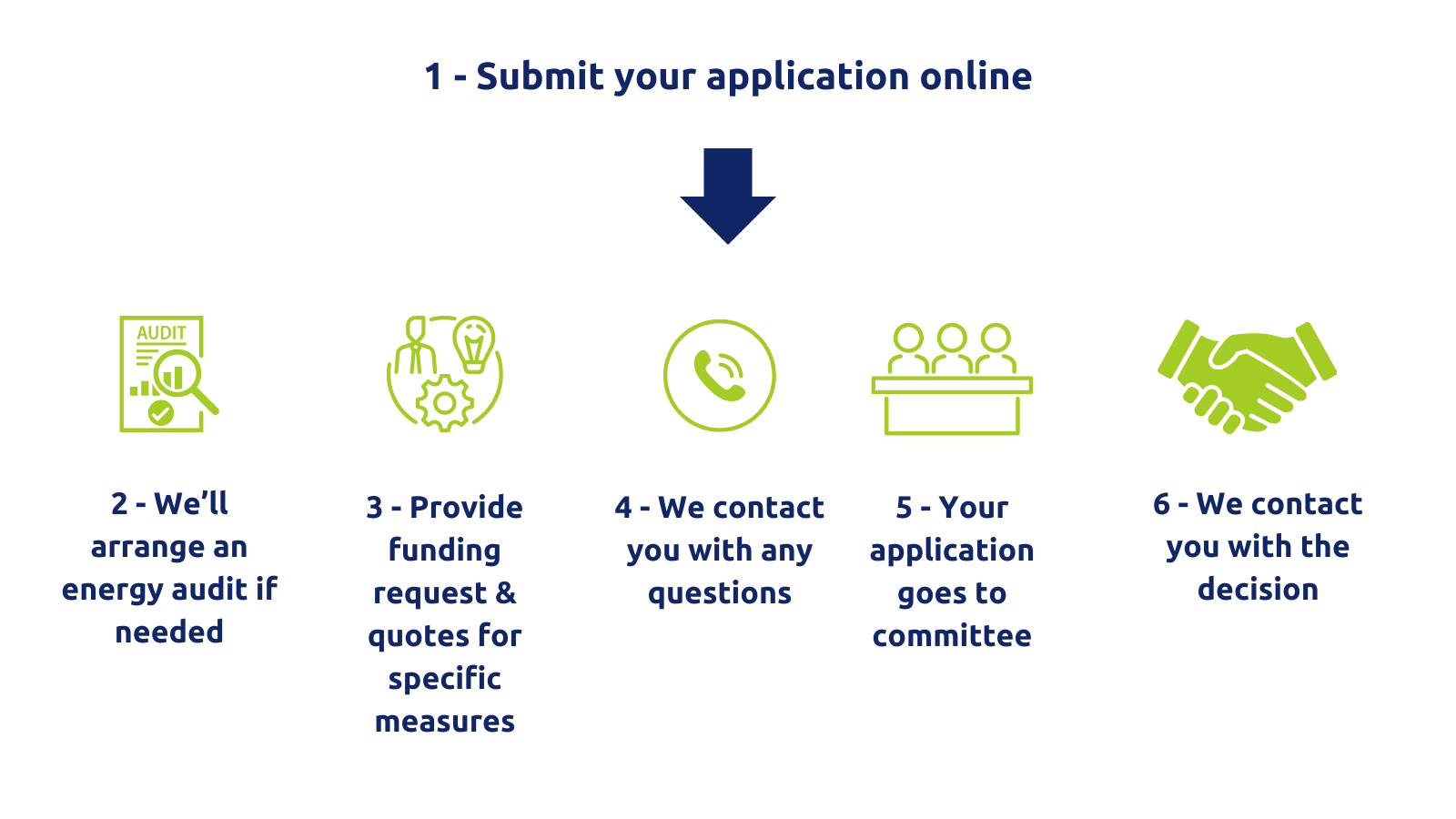

How do I apply?

Chat to us

Not sure if this fund is for you? Want to talk about your eligibility or any questions you have about the application process? We’re happy to help, just get in touch with us or one of the fund partners here:

- Social Investment Business – loans@sibgroup.org.uk

- Big Issue Invest – https://www.bigissue.com/invest/contact/

- Charity Bank – jrmurray@charitybank.org

- Co-operative and Community Finance – tim@coopfinance.coop

- Groundwork – enterprisedevelopment@groundwork.org.uk

- Resonance Ltd – https://resonance.ltd.uk/contact/contact

- The Ubele Initiative – phil.tulba@ubele.org

- The Architectural Heritage Fund – https://ahfund.org.uk/about-us/contact-us/

Frequently Asked Questions

How does the fund work?

With £500k from Social Investment Business Foundation, £5.3million from Better Society Capital, and c. £9million from Access – the foundation for social investment, the Fund will combine repayable finance with grant funding to provide a package of energy audit support and blended funding of loan and grant to eligible charities and social enterprises for energy efficiency measures.

Is there a minimum or maximum amount that I can request?

You can apply for between £25,000 to £250,000 (inclusive of 40% grant element). This will be made up of a fixed amount of loan (60%) and grant (40%).

What can I use the funding for?

The funds must be used to install energy saving measures or generation technology to buildings/ land (including new builds), and/ or purchase energy efficient or environmentally friendly vehicles or equipment.

If you are applying to install energy saving/ generating measures to a building/ land, what the Fund will support must be informed by an Independent Energy Assessment.

Common interventions could include (but are not limited to):

- Energy efficient/saving lighting systems.

- Insulation installation/upgrades.

- Glazing upgrades.

- Solar PV panel systems.

- Battery storage systems.

- Solar water heating systems.

- Heat pumps or other forms of energy efficient heating systems (including gas boiler upgrades).

- Small scale wind turbines.

- Low head hydro systems.

- Electric vehicles.

- Energy efficient/ environmentally friendly equipment e.g. catering or manufacturing equipment.

Common electric vehicles could include (but are not limited to):

- Battery electric vehicles.

- Plug in hybrid vehicles.

- Hydrogen vehicles.

The Fund can also cover a wide range of costs. This may include (but is not limited to):

- Capital costs of the material/equipment itself.

- Labour costs of the installation or changes to building fabric.

- Costs of project management.

- Costs (within reason) for work directly required to enable the energy efficiency measures to be implemented.

- Revenue losses (within reason) considered up to a maximum of 15% of the total funding (unless there are clear reasons for higher levels by exception) if the work will disrupt income for a period of time.

- Building Management Systems (BMS) to optimise management of all energy efficiency technology and sensors.

- Training for staff in relation to building energy efficiency management.

- Training for building users in relation to energy use of the building.

- Project budget contingency.

Can I use the funding solely to enable other energy efficiency work?

Yes. You can obtain funding solely to enable other energy efficiency work to happen. For example, if an organisation has already been awarded grant funding from another source for solar panels but can’t fit them to their roof without it being reinforced to take the weight of the panels, the Fund could pay for the roof work to enable the solar panels to be fitted. The Fund does not require an Independent Energy Assessment if you are solely looking to enable other energy efficiency work.

Is there anything the funding can’t be used for?

The funds cannot be used for:

- Refinancing of existing debt (except in exceptional circumstances).

- In relation to land/buildings, energy efficiency measures not identified within an Independent Energy Assessment or backed up by a clear and evidence-based rationale.

- Untested technology.

- Community energy or heating generation projects such as district heat networks, solar or wind farms or large hydro power projects, or nuclear energy and/or where the primary purpose is to sell the energy to a 3rd party. Note – this does not prevent ERF funding an organisation from implementing an energy generating measure on their land rather than their building, but the primary purpose has to be to supply energy to their own building.

- Community energy organisations that bring groups of people or organisations together to purchase, manage, generate, or reduce consumption of energy.

- Hybrid Electric Vehicles that cannot be plugged into the mains as the engine is still the main power source. For clarity Plug in Hybrid Vehicles (PHEVS) are eligible.

- Facilities primarily for statutory services e.g. hospitals, state funded primary or secondary schools, universities etc.

- Buildings or sections of them used primarily for political campaigning.

- Buildings or sections of them used for worship/ furtherance of faith, unless:

- >50% of activity/usage of the building is for community services, and the

- energy efficiency measures being funded benefit the areas of the building used primarily for community services.

Is there a minimum or maximum repayment term for the loan element?

You can repay the loan over a term of between 1 to 10 years (inclusive of any capital repayment holiday). There is the option of up to a 12-month capital repayment holiday at the start of the loan – interest will still be payable from month one. We will consider affordability and the term of your loan during the assessment of your application.

How much will I be charged for the loan element?

The loan will be charged at a rate of 8.5% fixed per annum on the loan balance. Interest is calculated on the declining outstanding balance. You will also be charged an arrangement fee of 2.5% on the value of the loan which will be added to your loan balance. You can prepay the loan at any time without penalty.

Will I need to provide security for the loan element?

The fund is intended to provide unsecured loans. We would only take security by exception (if at all) and only after very careful consideration and with the agreement of the organisation. The applicant must pay the legal costs of any security or intercreditor agreements (if any) in full upon disbursal of the loan.

Can I have a grant without the loan?

No. The fund offers loan funding, with a grant that sits alongside the loan to help make it more accessible and affordable.

I want to use the funding to refinance existing debt, is this allowed?

No, this fund cannot be used to refinance existing debt (except in exceptional circumstances).

What is an Independent Energy Assessment?

It is an independent assessment that identifies possible energy efficiency opportunities in your building. It will normally involve a site visit by an energy assessor and a written report outlining all possible opportunities. Your organisation will use this report to help you decide which energy efficiency measures you would like to pursue as an organisation and which you would like the ERF funding to support.

How do I get an Independent Energy Assessment?

If you apply to the Fund to install energy saving/ generating measures to a building/ land, and you don’t already have a suitable Independent Energy Assessment, we will refer you to one of the Funds approved Energy Audit Suppliers for one to be carried out and paid for by the Fund (subject to your application being eligible for the Fund).

The Independent Energy Assessment will include some limited follow-on support:

- Up to 1-hour Teams call with the Energy Audit Supplier to run through the report and to ask questions and have technical information explained,

- Further iterations (max. 3 sets of iterations) to the report (if needed), and

- Up to 1-hour Teams call with the Energy Audit Supplier to help you decide which energy efficiency measures to pursue with the blended funding offered by the Fund.

The purpose of the follow-on support it to ensure:

- The final audit report is appropriate for your organisation’s needs,

- You understand the report, its contents (including technical information), the recommendations made and prioritisation for implementation, and

- You can make an informed decision on which energy efficiency measures to pursue with the blended funding offered by the Fund.

I already have an Independent Energy Assessment, do I need to get a new one for this fund?

No. The Fund will accept existing Independent Energy Assessments provided they are for the building/ land where you would like to install the energy saving/ generating measures, they are recent (dated within the last 24 months), they are suitable (see below), and there have been no significant changes to the energy use/ fuel type/ building structure since the audit was done. If you already have an Independent Energy Assessment, you will be asked to upload a copy to your application.

Do I need an Independent Energy Assessment if I am applying for vehicles/ equipment?

If you are applying solely for a vehicle or standalone equipment e.g. catering or manufacturing equipment, the Fund does not require an Independent Energy Assessment for the vehicle/ equipment.

If however, you are applying to install energy saving/ generating measures to buildings/ land and this requires equipment e.g. heat pumps, solar panels, the Fund requires an Independent Energy Assessment for the building/ land and for these items to be recommended in the assessment.

What does the Fund deem to be a suitable Independent Energy Assessment?

If you are applying to the Fund to install energy saving/ generating measures to a building/ land, and you already have an Independent Energy Assessment for that building, you will be asked to upload a copy to your application. We will then review it to make sure it is of good quality and includes the key information we need to use it as the basis for the blended funding.

What does the Fund deem to be an acceptable lease?

If you are applying to the Fund to install energy saving/ generating measures to a building/ land, you must either own or have an acceptable written lease agreement with a minimum of 12 years remaining on it for the building/ land you would like the funding for. If you lease the building/ land you will be asked to upload a copy of the lease to your application. We will then review it to make sure we think the lease is acceptable for us to offer the blended funding against.

What does incorporated mean?

The organisation is registered as a legal entity with a separate legal identity from those who own or run it.

Will the fund lend alongside other lenders?

The Fund can make loans alongside other lenders or grant providers. However, consideration will be given to how the overall investment will affect an organisation’s financial position and its ability to repay the loan element.

Where can I find my building’s EPC/ DEC rating?

If you or your landlord do not know the Energy Performance Certificate (EPC) or Display Energy Certificate (DEC) rating for your building, you can find it here: https://www.gov.uk/find-energy-certificate.

What if my organisation would like to apply for funding for multiple sites?

If you would like to apply to the Fund for funding for multiple sites, you must submit one application per site.

How do I decide which Fund partner to work with?

When you fill in your application you will be asked to select a Fund partner to assess your application. If they recommend your application for funding, they will also present their recommendation to the Fund’s Investment Committee.

It is entirely up to you which partner you decide to work with.

When we receive your application, if we think it would make sense for a different partner, to the one you have selected to assess your application for any reason, we will discuss this with you.

Our registered address is different from our main premises – is that a problem?

No. That’s fine.

What should I expect when completing the application form?

The application is relatively straight forward. It collects mostly contact information and organisation data. It doesn’t have lots of free text questions.

You will be asked to upload to your application your:

- Last 2 sets of approved financial accounts (showing figures for 3 years, if available),

- Latest set of management accounts, and

- 12 month cashflow forecast for the current financial year.

If you are applying to install energy saving/ generating measures to building/ land, you will also be asked to upload (for the building/ land you would like the funding for) your:

- Title Deeds or an acceptable written lease agreement, and

- A suitable Independent Energy Assessment (only if you already have one).

The application should take approximately 25 minutes to complete if you have all information to hand. You can save the application and resume later, if needed. Once submitted you will receive an auto acknowledgement email with a PDF copy of your application attached.

Note: If your application is deemed to be eligible/ suitable and you are applying to install energy saving/ generating measures to a building, you will also be asked to provide 12 months of gas and electricity bills at the next stage (see below). We recommend you collate these in advance to avoid holding up the process.

What should I expect after I have submitted the application form?

Once you have submitted your application, the partner will review it to make sure it is eligible and suitable (Stage 1 Assessment) for the Fund and let you know the outcome.

If your application is to purchase energy efficient or environmentally friendly vehicles or equipment: The partner will ask you to provide quotes for the vehicles/ equipment. The partner will then review your organisation, proposal and funding request in full (Stage 2 Assessment) and will contact you to run through your plans and any questions they have.

If your application is to install energy saving measures or generation technology to buildings/ land (including new builds): SIB will ask you to provide 12 months of gas and electricity bills (this is so we can track changes in energy consumption and cost over time). SIB will review your Independent Energy Assessment (if you already have one) or refer you onto one of the Funds approved Energy Audit Suppliers for one to be carried out and paid for by the Fund. Once the Independent Energy Assessment is complete, the partner will ask you to develop your proposal further e.g. decide which energy efficiency measures you would like the funding for, obtain the relevant permissions for the works, obtain quotes for the works. The partner will then review your organisation, proposal and funding request in full (Stage 2 Assessment) and will contact you to run through your plans and any questions they have.

If following the Stage 2 Assessment the partner feels able to recommend you for funding, their recommendation will be shared with their Internal Panel, and, if approved by them, it will be sent the Funds Investment Committee for a final decision. The partner will notify you of the decision following the Investment Committee.

If approved by the Investment Committee, SIB will send you the offer documents for signing, carry out various due diligence and disbursal checks, and disburse the funds to your organisation.