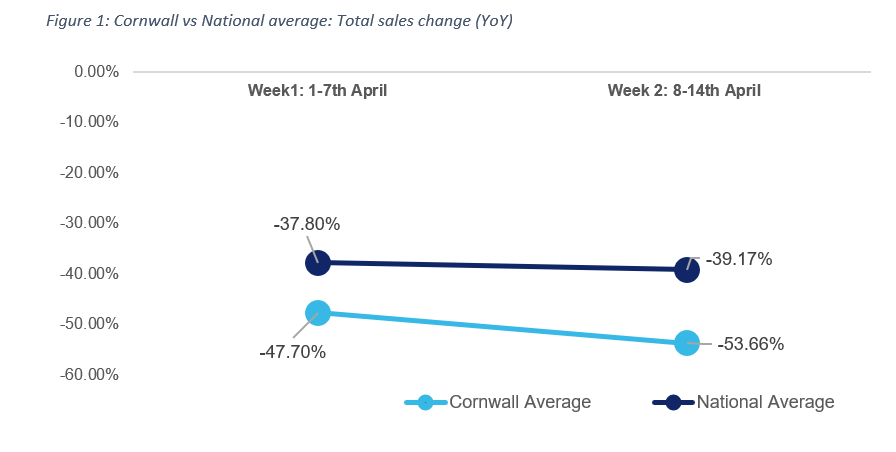

As we move into the second week of our partnership with Tortoise, our Director of Learning and Influence Genevieve Maitland Hudson shares key local economic insights from the South West, and what this means for the post-COVID recovery for the social economy.

This week’s Tortoise deep dive takes us to the West Country and the struggles of Penzance as its seasonal economy is starved of visitor revenue. COVID-19 will hit many areas in Cornwall particularly hard. Its patterns of pre-existing deprivation are precisely those most susceptible to this crisis.

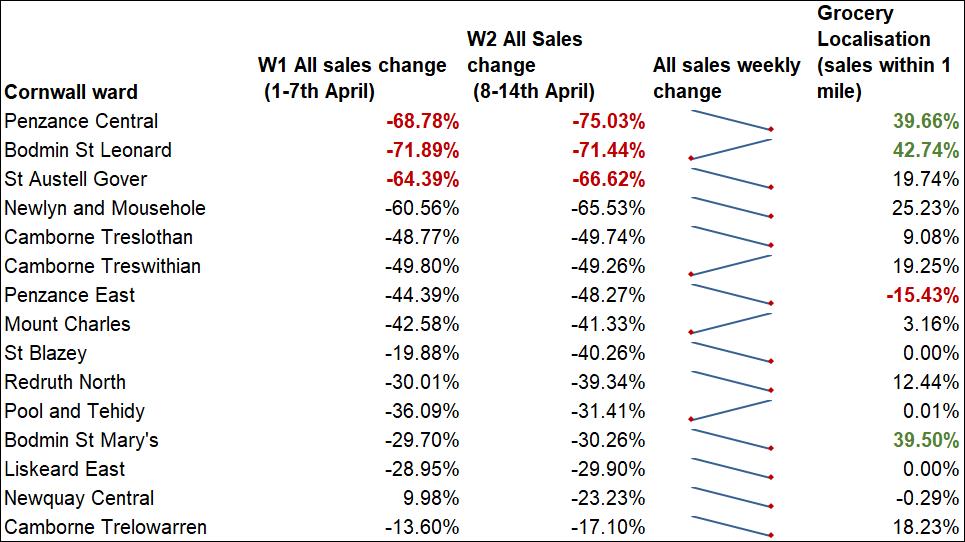

The index of multiple deprivation shows that Cornwall has 17 neighbourhoods in the top 10% of most deprived areas in the UK. Three of these are in Penzance. All of these neighbourhoods score particularly high on the index for income and employment. In fact between 2015 and 2019, Cornwall’s deprived neighbourhoods dropped by 11 places in the ranking on income, and by 17 places in the ranking on the employment measure. This is reflected in figure 2 below (where 1 is most deprived and 10 is least deprived).

*Note, sales data is at ward level, 2 of those 17 neighbourhoods share a ward, thus the list reflects the 15 wards representing those neighbourhood in order to stay consistent across data sets presented.

This was already a worrying trend, and income and employment are being further depressed by social distancing measures. These are neighbourhoods that were already in desperate need, and our data shows how that need is being further entrenched.

For the Penzance wards in particular, the data is stark. There is a 75% drop in sales in Penzance Central compared to 2019 in the week of 8-14 April. That drop has to be understood in the context of a signficant shift in the localisation of spending, which shows an almost 40% rise. That tells us that local people are spending more nearer to home, but that their spending power cannot come close to stemming the loss of revenue from the tourist economy. Those two statistics alone tell us the whole tale of Penzance’s deprivation: local employment and local income are simply too low to prop up the ward’s consumer facing businesses and that despite the 22% rise in grocery spending.

The deprived wards of Bodmin St Leonard and St Austell Gover are not far behind. The former has seen a 71% drop in sales revenue, the latter’s takings are down by 67%. Bodmin’s pattern of localisation echoes Penzance, a 42% shift of local spending. St Austell’s is less high, at only 20%, but is telling the same story. In neither case can local spending make up for the incoming pound from visitors to Cornwall.

It is also worth noting that all three of these wards are in the 10% most deprived in the country for health deprivation and disability. Public Health England’s health profiles at GP surgery level suggest that the population is a vulnerable one. All three central Penzance surgeries report over 40% of their patients to be over 65, and only 50% of their total patients to be in full-time education or employment. Reported numbers with a long term health condition are also well above the national average for GP surgeries in England. At two of these surgeries the proportion stands at 70% of the reported patient list.

These are communities that desperately need investment, but that investment cannot be extractive. There is no space here for traditional private capital that looks to extract a gain from an increase in property prices at the expense of local people who need jobs. What is needed instead is business that generates and grows its own underlying profitability, business with a social conscience.

Happily there are already examples that show this can work in Cornwall. Our Tortoise coverage picked up on the example of the Jubilee Pool, a community business that has received funding from the Architectural Heritage Fund, and indeed a small grant from SIB through the Access Foundation Reach Fund. The pandemic has already more than dented the pool’s opening of its new geothermal bath, but with the right support it can recover and continue to play a key role in a regeneration that has income and employment as its most important outcomes. Cornwall shows that there is a stark necessity for investment in the post-COVID recovery period, and also points towards how that recovery should be shaped.

Read last week’s blog on the week 1 of our Tortoise partnership here.If you’re looking for a breakdown of the latest Government advice for businesses, and current emergency funding opportunities, visit our COVID-19 Resources and Information page.